BOSSA: BIG DATA

2.3+ million Chinese Consumers intending to Study Abroad (2021)

Introduction

BOSSA is China’s education agency association

Established in 2004 as a non-profit organization for agencies recognized by the Ministry of Education, BOSSA is now an independent body, representing the study abroad industry.

BOSSA is China’s education agency association. Established in 2004 as a nonprofit organization for agencies recognized by the Ministry of Education. BOSSA is now a membership body representing the country's study abroad services industry BOSSA is fully managed and operated independently; its staff do not work for any education agencies and are employed by BOSSA.

It is not a volunteer-based association, all member agencies are verified as legitimate companies operating within the study abroad industry.

Our collective member agencies are located throughout China, from the largest corporations to small consultancies.

Some of the members include New Oriental, JJL, Can Achieve, Shinyway, and AOJI.

Over 1,500 individual agents have been certified through our training course, CEAC, which we launched with ICEF and the Ministry of Human Resources.

If you're familiar with us, you're probably aware of COSSA, our sub-association that was set-up in 2012 to serve members not based in Beijing. Hence our website domain, www.bossa-cossa.org

And to quickly explain why we have big data on Chinese consumers planning to study abroad - late last year we branched out into the digital space by launching a platform (called iBOSSA) to help connect our member agencies with potential students.

We also wanted to help Chinese students and parents identify reputable agents in their cities, and refer them according to their preferences in degrees and destinations overseas.

The Data

BOSSA: BIG DATA | CITIES & PROVINCES

2,343,259 individual users per day & 72 hours of internet activity

To kickoff our first round of big data: If you've been to a BOSSA Conference, you may recall our stance on the growing importance of 2nd and 3rd tier cities for the past several years.

What you will see below is info on 2.34 million Chinese consumers who are planning to study abroad.

Note these locations are not the origin of current students abroad. For the sake of space, we'll only touch on the top 2 cities, Beijing and Shanghai, as well Guangdong province, and a few other locations.

Beijing

Beijing still by far has the highest concentration of education agencies in China and is the country's education capital for its top universities, as well as the number of universities. Many educators, when they plan their recruitment actions, think of Beijing...just about all the largest agencies in China are headquartered in Beijing and have multiple offices in 2nd and 3rd tier cities. So if you're partnered or wanting to partner with a big agency, ask what other cities do they have branches in, and see if they can try promoting you in those locations.

Shanghai

Why is Shanghai ranked first? These numbers represent individuals who are seeking info for themselves, and Shanghainese consumers are usually sophisticated and savvy about finding info on overseas institutions. Also the highest amount of private or international schools per capita is in Shanghai. Consumers there don't utilize agencies as much as Beijing. They also prepare in other ways to study abroad, like through their school, trusted peers, or direct channels. Thus if you're recruiting from Shanghai, you can still enlist an agent, but you should consider other methods to get in front of consumers.

Guangdong Province

As you see in the chart above, Guangdong province has the largest market share of students planning to go abroad. Given that Guangzhou and Shenzhen, 2 of China's top 4 cities are only a quick train ride from each other, as well as all other emerging cities like Dongguan and Foshan. Currently, there is a high emphasis by governmental authorities to make Guangdong province the leading province in education. Countless new international schools are going up, Guangdong is the wealthiest province in China and has a long history of international trade with close proximity to Hong Kong. And last, behind Guangdong province are Jiangsu and Zhejiang provinces.

Consider adding Hangzhou, Nanjing, and Suzhou to your recruitment destinations, as well as central Chinese cities like Chongqing, Wuhan, and Chengdu. All of these cities are considered new first-tier cities or more commonly known as 2nd tier cities.

BOSSA: BIG DATA | STUDY DESTINATION PREFERENCES

2,357,902 individual users per day & 96 hours of internet activity

To specify; this data is on consumers who are planning to go abroad, and not currently abroad.

A common question is, "has the current situation affected Chinese students' desire to study abroad and has the pandemic led to any shift in favored destinations? " Our answer is, the desire for study abroad isn't going anywhere.

As a matter of fact, it will stay on an upward slope. However, the secondary education market, summer camps, and short-term programs abroad are taking major hits. This year might be somewhat better than last's, but we're not sure by how much. United States The US is still regarded as the gold standard in education, according to most agencies, but a combination of internal factors within the US and the rise in competing destinations might be plateauing its demand.

The US will remain the top study destination in terms of total numbers, however.

United Kingdom Currently the UK, even before the pandemic, is benefiting from favorable visa policies and is also gaining the most from the US's stagnation. This data proves that more people in China are prospecting the UK above any other destination in the world.

Europe

English-taught programs in Europe are gaining massive interest. The massive uptick in interest in Germany, France, and Switzerland was surprising yet expected. As 2nd and 3rd tier city consumers enter the market, we're seeing more dispersion into non-Anglo study destinations.

Australia & New Zealand

Another common question from Australia and New Zealand is, since they are still closed, will Chinese students that wanted to go there wait until 2022? Students are still doing their courses online, waiting for the borders to open.

Sure there will be a minority share of switches to other destinations, but it's fair to presume Australia and New Zealand-bound students will wait it out. Some agents think that the current geo-pollical relationship between China & Australia will cause a temporary slowdown in enrollment this year, deflecting students to other Asian-Pacific or European destinations.

BOSSA: BIG DATA | STATISTICS OF STUDENTS

2,357,902 individual users per day & 96 hours of internet activity

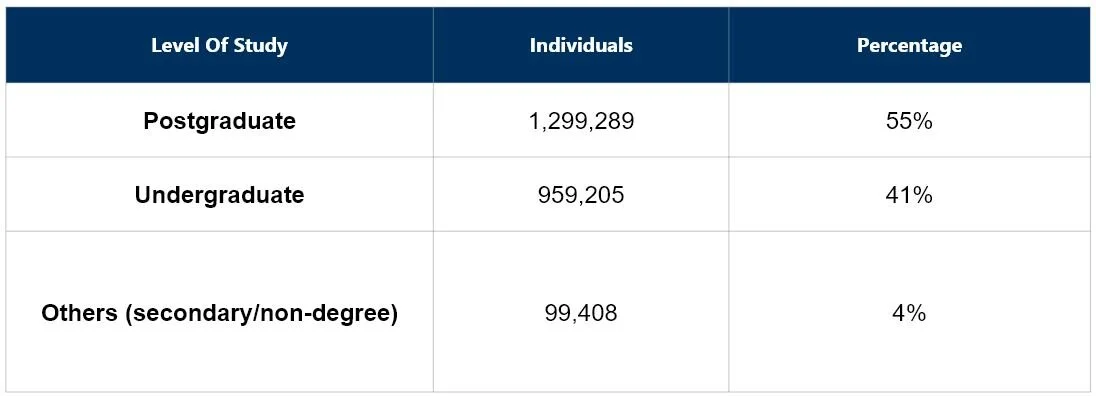

Now almost a year later, our latest data on the levels of study being searched for now. You see the vast majority of students are seeking information on Masters or undergrad programs overseas, and a very small ratio to secondary education.

This 4 percent does not reflect the size of the market, but indicates that fewer parents are searching for info on overseas schools in the secondary sector. Prior to the pandemic, Postgrad and Undergrad were more or less equal, and secondary bound students kept increasing.

Most agents confirm that university bound students will either postpone or just go ahead with their plans to study abroad this year. So those of you in Higher Ed, do maintain your plans for a long-term recruitment strategy. For those of you in secondary education: There has been somewhat of a shift to international schools in China as opposed to going abroad to boarding or private schools.

And many would-be overseas students currently enrolled in an international school have already enrolled for next year as well. But on the flipside, many parents still have the perceived value of in-country immersion and start the planning process years in advance. The secondary education market has gotten tighter, and you need to keep building or maintaining relations with your in-country recruiters